Harshad mehta bull run rajkotupdates news :some stories leave an indelible mark, and the Harshad Mehta Bull Run is undoubtedly one of them. This captivating saga, set against the backdrop of India’s financial landscape, is a tale of ambition, manipulation, and unprecedented market surge. Join us as we delve into the details of this iconic event that shaped India’s financial history.

Also read : https://voltrange.com/2023/08/08/windows-11-rajkotupdates-news-know-all-about-2/

Introduction

India witnessed a financial spectacle that defied expectations and transformed the country’s stock market. This awe-inspiring event, known as the Harshad Mehta Bull Run, redefined the norms of market behavior and highlighted the potential for both extraordinary gains and catastrophic losses.

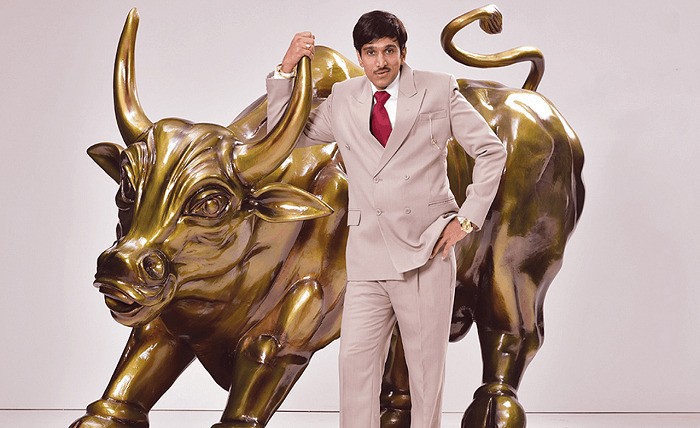

Harshad Mehta: The Enigmatic Figure

At the center of this whirlwind was Harshad Mehta, a charismatic stockbroker whose cunning strategies and audacious moves earned him the moniker “The Big Bull.” Mehta’s rise from humble beginnings to becoming a prominent figure in the financial world was nothing short of remarkable.

The Genesis of the Bull Run

The bull run had its origins in the late 1980s, fueled by economic reforms and the opening up of India’s markets. This period saw a surge of interest in the stock market, with investors eager to capitalize on the opportunities presented by a liberalizing economy.

The ‘Big Bull’ Phenomenon

Harshad Mehta’s approach to trading was unconventional, marked by his ingenious use of loopholes in the banking system. His strategy, famously termed “stock market manipulation,” involved exploiting discrepancies between interbank transactions and stock prices.

The Stock Market Frenzy Unleashed

As Mehta’s reputation grew, so did the fervor surrounding his stock recommendations. Investors followed his lead, pouring their funds into a select group of stocks, leading to an unprecedented market boom.

The Role of Financial Institutions

Mehta’s operations were facilitated by complicit banking officials who helped him secure massive loans against nonexistent securities.Harshad mehta bull run rajkotupdates news : This collusion between financial institutions and brokers played a crucial role in sustaining the bull run.

The Scam That Unraveled

However, all bubbles eventually burst, and the Harshad Mehta Bull Run was no exception. A series of events led to the exposure of Mehta’s fraudulent activities, triggering a market crash and massive losses for countless investors.

Repercussions and Aftermath

The aftermath of the bull run saw a wave of litigation, investigations, and regulatory reforms aimed at preventing similar incidents. The scam prompted a reevaluation of market regulations and investor protection mechanisms.

Lessons Learned: Regulatory Changes

The Harshad Mehta saga prompted significant changes in India’s financial regulations. Stricter oversight, improved transparency,Harshad mehta bull run rajkotupdates news : and enhanced risk management became cornerstones of the new regulatory framework.

Legacy of the Harshad Mehta Bull Run

The bull run’s legacy is one of cautionary tales and market wisdom. It highlighted the potential dangers of unchecked market euphoria and the importance of due diligence for both investors and regulators.

Market Speculation: Then and Now

Decades later, echoes of the Harshad Mehta Bull Run can still be heard in market events driven by speculation and irrational exuberance. It serves as a reminder that markets are susceptible to irrational behavior, regardless of advancements in technology and regulation.

The Psychological Impact on Investors

The bull run underscored the psychological aspect of investing, revealing how herd mentality and emotions can significantly influence market trends. Investors today are reminded to maintain a balanced and rational approach to their investment decisions.

Analyzing Market Manipulation

The Harshad Mehta case continues to be studied by economists and analysts as a prime example of market manipulation. It highlights the intricate interplay between market dynamics, regulatory loopholes, and individual actions.

Unpredictability vs. Sustainable Growth

One of the enduring lessons Harshad mehta bull run rajkotupdates news :of the bull run is the delicate balance between unpredictability and sustainable growth in the stock market. Mehta’s meteoric rise and fall demonstrated the need for cautious optimism in investment strategies.

The Modern Investment Landscape

Today, as we navigate a digital and interconnected financial world, the Harshad Mehta Bull Run remains a touchstone for understanding the complexities and pitfalls of market dynamics. It reminds us that while opportunities abound, prudent decision-making remains paramount.

Conclusion

rajkotupdates news :The Harshad Mehta Bull Run stands as a testament to the power of human ambition, the allure of quick gains, and the enduring impact of financial decisions. It serves as a vivid reminder that the world of finance is a realm where calculated risk-taking must be coupled with ethical considerations. As we move forward, the lessons from this historic event continue to guide investors, regulators, and financial institutions in their pursuit of a stable and prosperous economic landscape.

FAQs

-

What was Harshad Mehta’s background before entering finance?

- Harshad Mehta began his career as a small broker in the Bombay Stock Exchange before making his mark in the financial world.

-

How did Harshad Mehta manipulate the stock market?

- Mehta exploited loopholes in the banking system to secure massive loans and artificially inflate stock prices.

-

What were the immediate consequences of the Harshad Mehta Bull Run?

- The bull run’s collapse led to a market crash, financial losses for many, and a widespread distrust in the financial system.

-

What regulatory changes were implemented after the scandal?

- The scandal prompted regulatory reforms focused on improved transparency, stricter oversight, and enhanced risk management.

-

How does the Harshad Mehta case impact modern investors?

-

The case serves as a cautionary tale, reminding investors to exercise diligence, avoid herd mentality, and prioritize rational decision-making.

More Stories

Is Sansui an Indian Company? True Or Not

Handles Salary Revision and Appraisal: 10 Fact

Is Walmart an Indian Company? True Or Not